Tax Return Joint Account . Web my wife and i opened a new interest earning bank account in joint names. Web please note that a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed for each ya. Web the tax implications of joint bank accounts. If the interest of a connected joint account and fixed deposit is more than rs.10,000. Web interest earned on joint accounts are taxable in the hands of both primary and secondary account holders. If you have a joint account with your spouse, hmrc has a simple rule to calculate the tax due: Web if you share a bank account with a parent or relative, you may have to file a t3 return this tax season. Web last updated 29 dec 2022. Web if you add your spouse’s name to a joint investment account with the intent of splitting income between your two tax. Interest was earned and tax withheld. 100k+ visitors in the past month

from www.pdffiller.com

Web last updated 29 dec 2022. 100k+ visitors in the past month Interest was earned and tax withheld. If you have a joint account with your spouse, hmrc has a simple rule to calculate the tax due: Web please note that a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed for each ya. Web if you add your spouse’s name to a joint investment account with the intent of splitting income between your two tax. Web the tax implications of joint bank accounts. Web if you share a bank account with a parent or relative, you may have to file a t3 return this tax season. If the interest of a connected joint account and fixed deposit is more than rs.10,000. Web my wife and i opened a new interest earning bank account in joint names.

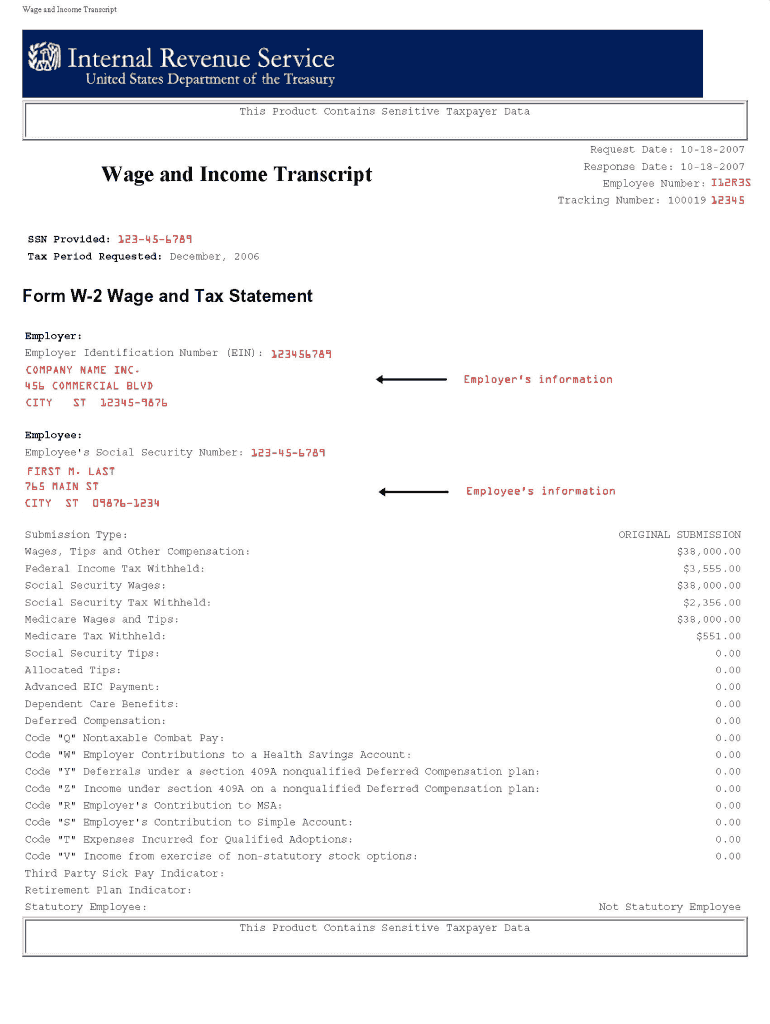

Fillable Online IRS Tax Transcript Sample. Sample Tax Return

Tax Return Joint Account Web please note that a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed for each ya. Web if you add your spouse’s name to a joint investment account with the intent of splitting income between your two tax. Web last updated 29 dec 2022. If you have a joint account with your spouse, hmrc has a simple rule to calculate the tax due: If the interest of a connected joint account and fixed deposit is more than rs.10,000. Web interest earned on joint accounts are taxable in the hands of both primary and secondary account holders. Web the tax implications of joint bank accounts. Interest was earned and tax withheld. Web please note that a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed for each ya. Web my wife and i opened a new interest earning bank account in joint names. 100k+ visitors in the past month Web if you share a bank account with a parent or relative, you may have to file a t3 return this tax season.

From neswblogs.com

Irs Tax Table 2022 Married Filing Jointly Latest News Update Tax Return Joint Account Web if you add your spouse’s name to a joint investment account with the intent of splitting income between your two tax. If the interest of a connected joint account and fixed deposit is more than rs.10,000. Web last updated 29 dec 2022. Interest was earned and tax withheld. Web my wife and i opened a new interest earning bank. Tax Return Joint Account.

From brainly.com

A married couple filing their federal tax return jointly had a Tax Return Joint Account Web if you add your spouse’s name to a joint investment account with the intent of splitting income between your two tax. 100k+ visitors in the past month If you have a joint account with your spouse, hmrc has a simple rule to calculate the tax due: Interest was earned and tax withheld. Web please note that a personal income. Tax Return Joint Account.

From www.linkedin.com

Understanding 2023 Tax Brackets What You Need To Know Tax Return Joint Account Web my wife and i opened a new interest earning bank account in joint names. Web interest earned on joint accounts are taxable in the hands of both primary and secondary account holders. Web last updated 29 dec 2022. If you have a joint account with your spouse, hmrc has a simple rule to calculate the tax due: 100k+ visitors. Tax Return Joint Account.

From www.divorceny.com

Husband Compelled to File Joint Tax Return? Divorce New York Tax Return Joint Account Web please note that a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed for each ya. Web the tax implications of joint bank accounts. Web last updated 29 dec 2022. 100k+ visitors in the past month Web if you share a bank account with a parent or relative, you may have. Tax Return Joint Account.

From www.ird.gov.hk

FAQ on Completion of Tax Return Individuals Tax Return Joint Account Web the tax implications of joint bank accounts. If you have a joint account with your spouse, hmrc has a simple rule to calculate the tax due: Web last updated 29 dec 2022. Web if you add your spouse’s name to a joint investment account with the intent of splitting income between your two tax. Interest was earned and tax. Tax Return Joint Account.

From taxfoundation.org

Monday Map Percentage of Each State's Federal Tax Returns Filed Tax Return Joint Account Web if you share a bank account with a parent or relative, you may have to file a t3 return this tax season. Web the tax implications of joint bank accounts. Web my wife and i opened a new interest earning bank account in joint names. If the interest of a connected joint account and fixed deposit is more than. Tax Return Joint Account.

From www.pinterest.com

A lot of married as well as separated couples file their tax Tax Return Joint Account Web last updated 29 dec 2022. Web interest earned on joint accounts are taxable in the hands of both primary and secondary account holders. Web if you share a bank account with a parent or relative, you may have to file a t3 return this tax season. 100k+ visitors in the past month If you have a joint account with. Tax Return Joint Account.

From projectopenletter.com

2022 Federal Tax Brackets And Standard Deduction Printable Form Tax Return Joint Account Web please note that a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed for each ya. Web the tax implications of joint bank accounts. 100k+ visitors in the past month Web if you share a bank account with a parent or relative, you may have to file a t3 return this. Tax Return Joint Account.

From www.wise-geek.com

What is a Joint Account Tax? (with pictures) Tax Return Joint Account Web interest earned on joint accounts are taxable in the hands of both primary and secondary account holders. If you have a joint account with your spouse, hmrc has a simple rule to calculate the tax due: Web my wife and i opened a new interest earning bank account in joint names. Web please note that a personal income tax. Tax Return Joint Account.

From www.rsgaccountants.com.au

6 Benefits Of Tax Return Services Melbourne Registered Tax Agent Tax Return Joint Account Web last updated 29 dec 2022. Web if you share a bank account with a parent or relative, you may have to file a t3 return this tax season. If you have a joint account with your spouse, hmrc has a simple rule to calculate the tax due: Web my wife and i opened a new interest earning bank account. Tax Return Joint Account.

From www.formsbank.com

Fillable Form 1040Ez Tax Return For Single And Joint Filers Tax Return Joint Account Web please note that a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed for each ya. Web the tax implications of joint bank accounts. Web if you share a bank account with a parent or relative, you may have to file a t3 return this tax season. Web interest earned on. Tax Return Joint Account.

From www.smbaccounting.com.au

Are you behind in your tax returns? SMB Accounting Tax Return Joint Account Web my wife and i opened a new interest earning bank account in joint names. If you have a joint account with your spouse, hmrc has a simple rule to calculate the tax due: If the interest of a connected joint account and fixed deposit is more than rs.10,000. Web if you add your spouse’s name to a joint investment. Tax Return Joint Account.

From charleanwgerry.pages.dev

2024 Married Filing Jointly Tax Brackets Golda Gloriane Tax Return Joint Account If you have a joint account with your spouse, hmrc has a simple rule to calculate the tax due: Interest was earned and tax withheld. Web interest earned on joint accounts are taxable in the hands of both primary and secondary account holders. Web please note that a personal income tax relief cap of $80,000 applies to the total amount. Tax Return Joint Account.

From issuu.com

U s tax return for single and joint filers with no Dependents Tax Return Joint Account Web if you share a bank account with a parent or relative, you may have to file a t3 return this tax season. Interest was earned and tax withheld. Web last updated 29 dec 2022. Web if you add your spouse’s name to a joint investment account with the intent of splitting income between your two tax. If the interest. Tax Return Joint Account.

From 1044form.com

Completing Form 1040 The Face Of Your Tax Return US 2021 Tax Forms Tax Return Joint Account Web please note that a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed for each ya. Web if you add your spouse’s name to a joint investment account with the intent of splitting income between your two tax. 100k+ visitors in the past month Web the tax implications of joint bank. Tax Return Joint Account.

From www.formsbank.com

Fillable Individual Tax Return Form City Of Huber Heights Division Tax Return Joint Account Web if you add your spouse’s name to a joint investment account with the intent of splitting income between your two tax. Web my wife and i opened a new interest earning bank account in joint names. If the interest of a connected joint account and fixed deposit is more than rs.10,000. If you have a joint account with your. Tax Return Joint Account.

From www.purposefulfinance.org

IRS 2021 Tax Tables, Deductions, & Exemptions — purposeful.finance Tax Return Joint Account Web please note that a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed for each ya. Web interest earned on joint accounts are taxable in the hands of both primary and secondary account holders. Interest was earned and tax withheld. Web if you add your spouse’s name to a joint investment. Tax Return Joint Account.

From www.irs.gov

3.11.3 Individual Tax Returns Internal Revenue Service Tax Return Joint Account Web if you share a bank account with a parent or relative, you may have to file a t3 return this tax season. If the interest of a connected joint account and fixed deposit is more than rs.10,000. Web please note that a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed. Tax Return Joint Account.