Hickman County Ky Property Taxes . The constitution of kentucky requires that “all property, not exempted from taxation by. All property is assessed as of that. To estimate your taxes please: Web kentucky property tax law establishes the assessment date as of january 1st of each year. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property. Web why have real estate taxes? Web the property assessor's office handles the mapping, appraising, and assessing of property in hickman county. Web if you feel your tax bill is incorrect, you should contact the hickman county property valuation administration at (270) 653. Web section 172 of the constitution of kentucky requires that all property be assessed for taxation at its fair cash value. Web the property valuation administrator makes every effort to produce and publish the most current and.

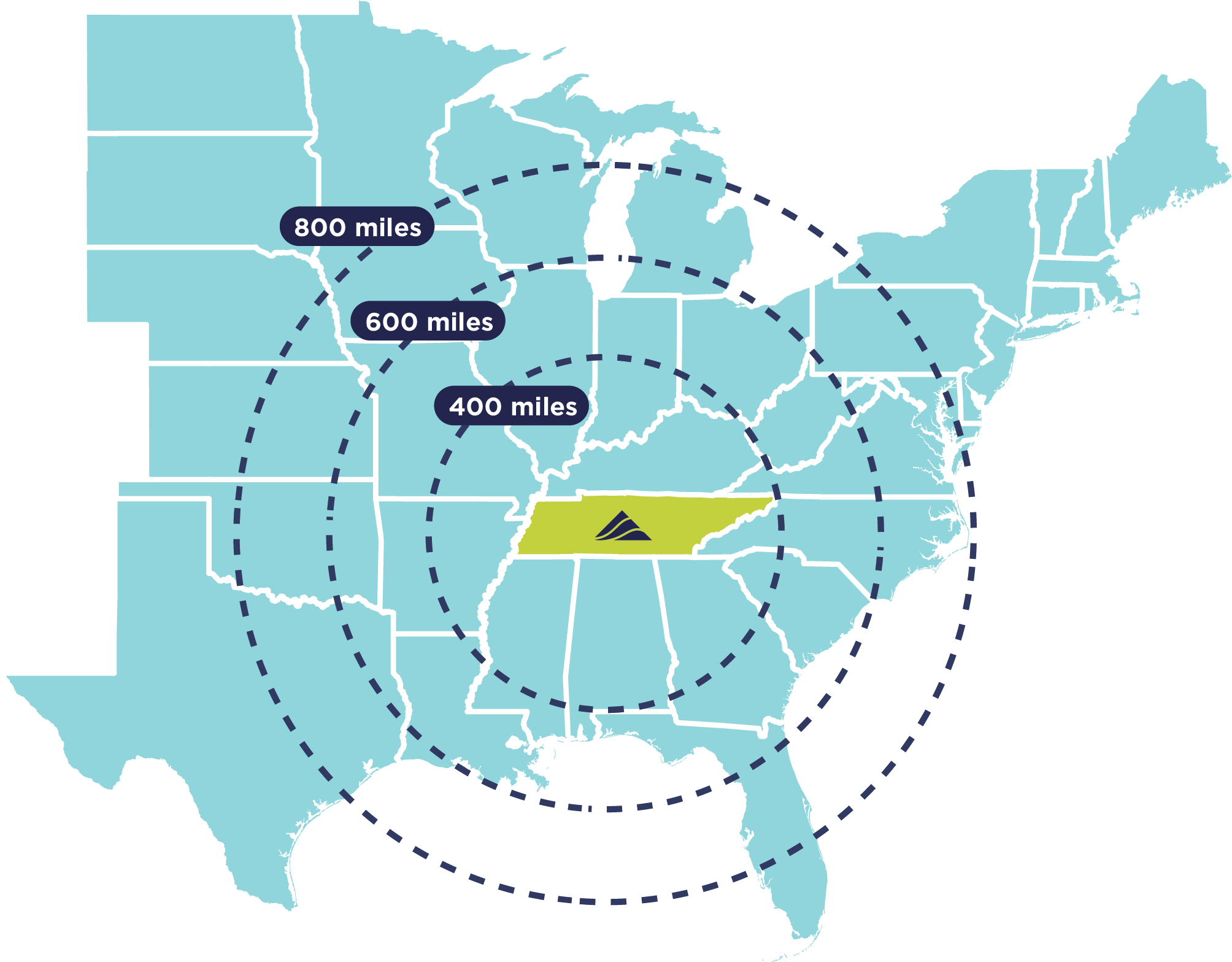

from hickmantnecd.com

Web section 172 of the constitution of kentucky requires that all property be assessed for taxation at its fair cash value. All property is assessed as of that. Web kentucky property tax law establishes the assessment date as of january 1st of each year. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property. The constitution of kentucky requires that “all property, not exempted from taxation by. Web if you feel your tax bill is incorrect, you should contact the hickman county property valuation administration at (270) 653. Web the property assessor's office handles the mapping, appraising, and assessing of property in hickman county. Web why have real estate taxes? Web the property valuation administrator makes every effort to produce and publish the most current and. To estimate your taxes please:

Business Resources Hickman County ECD Nashville's Back Yard

Hickman County Ky Property Taxes Web section 172 of the constitution of kentucky requires that all property be assessed for taxation at its fair cash value. The constitution of kentucky requires that “all property, not exempted from taxation by. Web if you feel your tax bill is incorrect, you should contact the hickman county property valuation administration at (270) 653. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property. Web the property valuation administrator makes every effort to produce and publish the most current and. To estimate your taxes please: Web why have real estate taxes? Web the property assessor's office handles the mapping, appraising, and assessing of property in hickman county. Web section 172 of the constitution of kentucky requires that all property be assessed for taxation at its fair cash value. All property is assessed as of that. Web kentucky property tax law establishes the assessment date as of january 1st of each year.

From www.niche.com

2023 Best Places to Live in Hickman County, KY Niche Hickman County Ky Property Taxes Web why have real estate taxes? Web kentucky property tax law establishes the assessment date as of january 1st of each year. Web section 172 of the constitution of kentucky requires that all property be assessed for taxation at its fair cash value. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by. Hickman County Ky Property Taxes.

From www.mapsales.com

Hickman County, KY Wall Map Premium Style by MarketMAPS Hickman County Ky Property Taxes Web section 172 of the constitution of kentucky requires that all property be assessed for taxation at its fair cash value. Web kentucky property tax law establishes the assessment date as of january 1st of each year. All property is assessed as of that. Web why have real estate taxes? The constitution of kentucky requires that “all property, not exempted. Hickman County Ky Property Taxes.

From www.flickr.com

Hickman County Courthouse Clinton, Kentucky County marker… Flickr Hickman County Ky Property Taxes Web the property assessor's office handles the mapping, appraising, and assessing of property in hickman county. The constitution of kentucky requires that “all property, not exempted from taxation by. Web section 172 of the constitution of kentucky requires that all property be assessed for taxation at its fair cash value. To estimate your taxes please: Web why have real estate. Hickman County Ky Property Taxes.

From www.hickmancountykyhistory.org

hickman county ky. historical society hickmancountykyhistory Hickman County Ky Property Taxes To estimate your taxes please: Web why have real estate taxes? Web if you feel your tax bill is incorrect, you should contact the hickman county property valuation administration at (270) 653. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property. Web section 172 of the constitution of kentucky requires. Hickman County Ky Property Taxes.

From www.tncenturyfarms.org

Hickman County Tennessee Century Farms Hickman County Ky Property Taxes Web kentucky property tax law establishes the assessment date as of january 1st of each year. To estimate your taxes please: Web the property valuation administrator makes every effort to produce and publish the most current and. Web section 172 of the constitution of kentucky requires that all property be assessed for taxation at its fair cash value. All property. Hickman County Ky Property Taxes.

From www.explorehickmancounty.com

Low Cost of Living Hickman County, KY Hickman County Ky Property Taxes To estimate your taxes please: Web why have real estate taxes? Web the property assessor's office handles the mapping, appraising, and assessing of property in hickman county. The constitution of kentucky requires that “all property, not exempted from taxation by. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property. All. Hickman County Ky Property Taxes.

From www.vahomeloancenters.org

Hickman County, Kentucky VA Loan Information VA HLC Hickman County Ky Property Taxes Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property. Web if you feel your tax bill is incorrect, you should contact the hickman county property valuation administration at (270) 653. Web section 172 of the constitution of kentucky requires that all property be assessed for taxation at its fair cash. Hickman County Ky Property Taxes.

From www.mapsales.com

Hickman County, KY Zip Code Wall Map Basic Style by MarketMAPS MapSales Hickman County Ky Property Taxes Web kentucky property tax law establishes the assessment date as of january 1st of each year. To estimate your taxes please: Web the property valuation administrator makes every effort to produce and publish the most current and. Web if you feel your tax bill is incorrect, you should contact the hickman county property valuation administration at (270) 653. The constitution. Hickman County Ky Property Taxes.

From www.pinterest.com

National Register of Historic Places listings in Hickman County Hickman County Ky Property Taxes Web if you feel your tax bill is incorrect, you should contact the hickman county property valuation administration at (270) 653. Web the property valuation administrator makes every effort to produce and publish the most current and. Web the property assessor's office handles the mapping, appraising, and assessing of property in hickman county. To estimate your taxes please: Web kentucky. Hickman County Ky Property Taxes.

From www.landwatch.com

Hickman, Fulton County, KY Farms and Ranches for sale Property ID Hickman County Ky Property Taxes Web why have real estate taxes? Web the property valuation administrator makes every effort to produce and publish the most current and. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property. Web section 172 of the constitution of kentucky requires that all property be assessed for taxation at its fair. Hickman County Ky Property Taxes.

From realestatestore.me

2018 Property Taxes The Real Estate Store Hickman County Ky Property Taxes To estimate your taxes please: Web the property valuation administrator makes every effort to produce and publish the most current and. Web section 172 of the constitution of kentucky requires that all property be assessed for taxation at its fair cash value. Web if you feel your tax bill is incorrect, you should contact the hickman county property valuation administration. Hickman County Ky Property Taxes.

From www.landsofamerica.com

0.55 acres in Hickman County, Kentucky Hickman County Ky Property Taxes To estimate your taxes please: All property is assessed as of that. Web why have real estate taxes? Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property. Web the property valuation administrator makes every effort to produce and publish the most current and. Web kentucky property tax law establishes the. Hickman County Ky Property Taxes.

From www.landsat.com

Hickman Kentucky Street Map 2136298 Hickman County Ky Property Taxes Web the property valuation administrator makes every effort to produce and publish the most current and. To estimate your taxes please: Web why have real estate taxes? The constitution of kentucky requires that “all property, not exempted from taxation by. Web section 172 of the constitution of kentucky requires that all property be assessed for taxation at its fair cash. Hickman County Ky Property Taxes.

From feedingamericaky.org

County Spotlight Hickman County Hickman County Ky Property Taxes Web the property valuation administrator makes every effort to produce and publish the most current and. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to assessment by the property. Web why have real estate taxes? Web kentucky property tax law establishes the assessment date as of january 1st of each year. To estimate your. Hickman County Ky Property Taxes.

From www.explorehickmancounty.com

Our History Hickman County, KY Hickman County Ky Property Taxes All property is assessed as of that. Web the property valuation administrator makes every effort to produce and publish the most current and. To estimate your taxes please: Web section 172 of the constitution of kentucky requires that all property be assessed for taxation at its fair cash value. The constitution of kentucky requires that “all property, not exempted from. Hickman County Ky Property Taxes.

From southerngenealogybooks.com

Hickman County, Tennessee Guardian & Administrative Settlement 1844 Hickman County Ky Property Taxes Web section 172 of the constitution of kentucky requires that all property be assessed for taxation at its fair cash value. All property is assessed as of that. The constitution of kentucky requires that “all property, not exempted from taxation by. Web kentucky property tax law establishes the assessment date as of january 1st of each year. To estimate your. Hickman County Ky Property Taxes.

From www.landsat.com

Aerial Photography Map of Hickman, KY Kentucky Hickman County Ky Property Taxes Web kentucky property tax law establishes the assessment date as of january 1st of each year. Web the property assessor's office handles the mapping, appraising, and assessing of property in hickman county. The constitution of kentucky requires that “all property, not exempted from taxation by. Web if you feel your tax bill is incorrect, you should contact the hickman county. Hickman County Ky Property Taxes.

From southerngenealogybooks.com

Hickman County, Tennessee Guardian & Administrative Settlements Volume Hickman County Ky Property Taxes Web if you feel your tax bill is incorrect, you should contact the hickman county property valuation administration at (270) 653. To estimate your taxes please: Web why have real estate taxes? The constitution of kentucky requires that “all property, not exempted from taxation by. Web krs.132.690 states that each parcel of taxable real property or interest therein subject to. Hickman County Ky Property Taxes.